High homeownership, volatile prices: key drivers of house price fluctuations in Czechia, Hungary and Poland

04.11.2024Antje Hildebrandt, Nico Petz

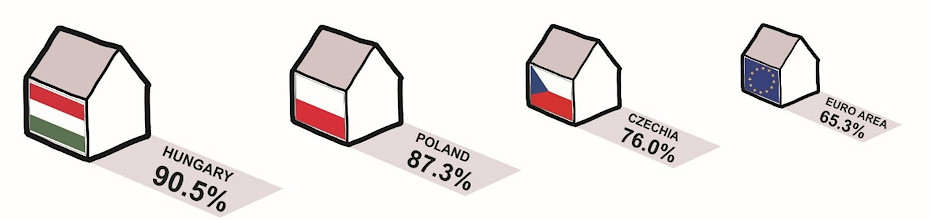

All Central, Eastern and Southeastern European (CESEE) EU countries have outstandingly high homeownership rates that are clearly above the EU average. Hungary has one of the highest homeownership rates in the EU, while homeownership is also quite prevalent in Poland and, to a slightly lesser extent, in Czechia. The importance of homeownership makes it particularly relevant to better understand the reasons behind the large fluctuations in house price growth we have seen in these countries over the past decade. Moreover, we, as central bankers, are also interested in house price developments as they inevitably have an impact on the economy as a whole and potential implications for financial stability. What are their main drivers? What role does housing demand play? And what about the impact of monetary policy?

Source: Eurostat

We focus our analysis on Hungary, Czechia and Poland, three important CESEE EU countries where house prices have increased strongly from 2015 to 2023: by over 170% in Hungary, more than 110% in Czechia and a still significant 80% in Poland, compared to the euro area average of 42%. And the trend continues: most recent data indicate continuously accelerating house prices in these three countries, with growth rates far above the euro area average in the second quarter of 2024.1, 2, 3

Decomposing the house price: what role do housing demand and monetary policy play?

There are several factors that potentially influence house prices: economic and financial conditions, risk aversion and changes in social preferences, to name just a few. To gain a better understanding of the drivers of house prices in Czechia, Hungary and Poland, we estimate an empirical model and calculate the historical decomposition of house price growth for each country. A historical decomposition allows us to break down the movement of house prices into past and present contributions from different economic factors at each point in time. Our model can explain the behavior of two potential drivers: housing demand and monetary policy. We are especially interested in these two factors, as they potentially account for a significant portion of house price fluctuations in recent decades. Housing demand changes for a variety of reasons, including economic conditions (e.g. income growth, employment levels), demographic trends (e.g. population growth, shifts in the age distribution) and changing preferences. A rise in the number of homebuyers will typically drive up prices, as higher demand meets limited supply. In addition, monetary policy directly affects the lending rates for housing loans. For instance, when the central bank lowers the policy rate, borrowing becomes cheaper, encouraging people to buy homes, thereby driving up prices.

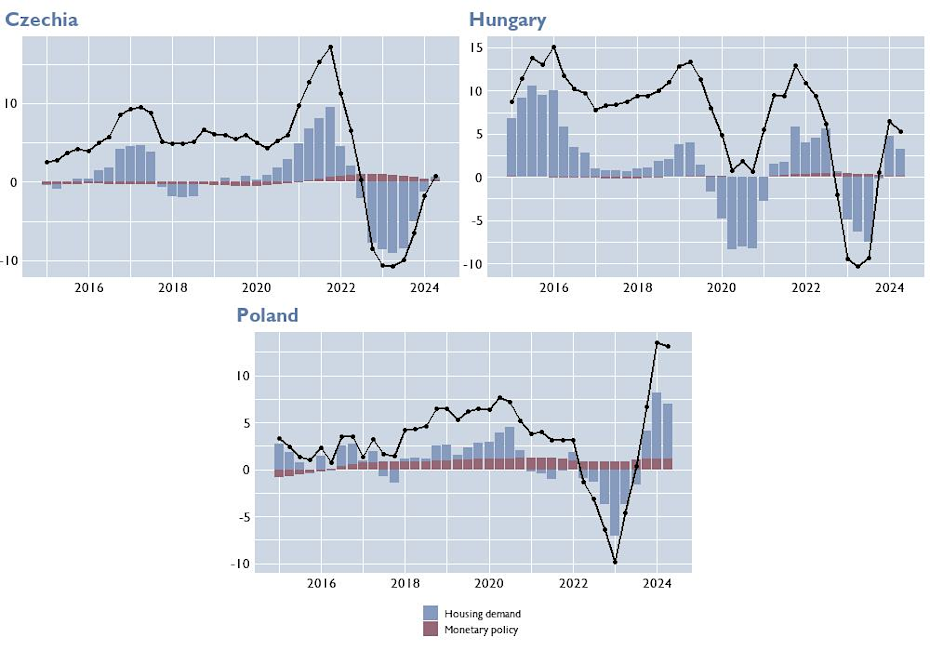

Sources: ECB, Eurostat, OECD and authors’ calculations.

Notes: The solid-dotted black line corresponds to the year-on-year change in the real house price index. The blue bars show, for each point in time, the contribution of housing demand to the real house price, the red bar the influence of monetary policy. We show the historical decomposition starting in 2015 and exclude the contribution of the model constant.

In the chart above, we present the contributions of housing demand and monetary policy to the annual change in the real house price index4. The pattern of house price growth looks quite similar across the three countries. In 2021, when the COVID-19 pandemic started to ease, prices increased in Czechia, Hungary and – to a lesser extent – in Poland. This was likely promoted by a comprehensive economic recovery and very low interest rates. The Russian invasion in Ukraine in February 2022 and energy price shocks led to high inflation and a weakening of economic activity. As a result, lower purchasing power likely supported the decline in house prices in 2022 and 2023 in all countries. In Czechia the decline lasted even until the first quarter of 2024. Most recently, house price growth has started to pick up against the background of more favorable macroeconomic fundamentals and lower financing costs. In Hungary and Poland, moreover, government support programs for housing have been an additional driver of housing demand.

For Czechia, we find that the monetary policy stance exerted moderate downward pressure on house prices until the interest rate hikes in 2022, which reversed this trend. Housing demand played a significant role following the initial shock of the COVID-19 pandemic, driving substantial price increases in 2020 and 2021. The subsequent decline in demand in the following years contributed to downward pressures on prices. In Hungary, the contribution of monetary policy to house price growth was modest throughout the period under review, with moderate upward pressure in the 2020s. Demand contributions were high throughout and were driving the overall dynamics very strongly. For example, during the COVID-19 pandemic, housing demand significantly contributed to the slowing down of house price growth. In 2021 and 2022, house price growth was positively impacted by demand effects. In 2023, as already observed in Czechia, housing demand explained large parts of decelerating house price growth. Poland’s monetary policy positively contributed to house price growth during the whole period under review. Demand effects were limited until the energy crisis, when falling demand strongly contributed to the downturn in house prices. The last two quarters show a notable increase in house prices, which was significantly driven by demand.

Concluding remarks

Understanding the behavior of the housing markets in Czechia, Hungary and Poland continues to be very important, as homeownership rates remain high and house prices have shown large fluctuations over the past decade. We use our empirical model to investigate the role of housing demand and monetary policy as a subset of many potential drivers of house prices in CESEE. Our results suggest that housing demand has been playing a significant role in determining house prices. This was particularly evident during the turbulent times of the early 2020s. In addition, monetary policy has shown moderate effects on the house price by directly affecting the cost of borrowing for housing loans.

1 Nominal changes of house prices, data provided by Eurostat.

2 For more information, refer to the OeNB Housing dashboardOeNB housing dashboard and to the latest OeNB Report: CESEE Property Market Review.

3 In the second quarter of 2024, nominal house prices increased annually by 4.2% in Czechia, by close to 10% in Hungary and by almost 18% in Poland compared to 1.3% in the euro area. Data provided by Eurostat.

4 The difference between what is explained by these two sources and the observed price series is a combination of various other economic drivers which our model does not individually identify. These additional factors could be related to real economic activity, credit conditions, risk aversion and/or changes in preferences.

The opinions expressed do not necessarily reflect the official viewpoint of the Oesterreichische Nationalbank or the Eurosystem.

References

Giannone, D., Lenza, M., and Primiceri, G. E. 2015. Prior selection for vector autoregressions. Review of Economics and Statistics, 97(2), 436-451.

Musso, A., Neri, S. and L. Stracca. 2011. Housing, consumption and monetary policy: How different are the US and the euro area? In: Journal of Banking & Finance. Vol. 35 (11). 3019-3041.

Nocera, A. and M. Roma. 2017. House prices and monetary policy in the euro area: evidence from structural VARs. ECB Working Paper No. 2073. June 2017.