1945–1998

1816 – 1818 |

1818 – 1878 |

1878 – 1922 |

1922 – 1938 |

1938 – 1945 |

1945 – 1998 |

from 1999 |

The Oesterreichische Nationalbank during the Second Republic

Reconstruction

The disastrous World War II years had taught society and politicians the importance of nonpartisan teamwork as the basic principle of an inclusive society in Austria. Reconstruction was a success, being driven by the stamina of all stakeholders and benefiting crucially from the European Recovery Program, known as the Marshall Plan.

After the reestablishment of the Republic of Austria on April 27, 1945, the Oesterreichische Nationalbank could also resume operation. The Central Bank Transition Act of July 3, 1945, provided the temporary legal basis for the central bank’s activities.

From December 21, 1945, the Austrian schilling replaced the Reichsmark and the Allied military schilling as Austria’s legal tender and sole unit of account.

A big part of the OeNB’s head office in Vienna served as the headquarters of the American occupying power from 1945 to 1951, which placed heavy constraints on the central bank. Making an all-out effort, the securities printing works nevertheless succeeded in producing the new schilling banknotes on schedule.

At first, the inflationary conditions persisted. Although the one-to-one exchange of Reichsmark banknotes and Allied military schillings was restricted to ATS 150 per person, the money supply measured in early 1946 totaled nearly six times the level prevailing at the end of 1937. In May 1947, monthly inflation reached double digits. The schilling was still clearly undervalued by comparison with foreign currencies.

The key measure to mop up the excess liquidity was adoption of the Currency Protection Act of November 19, 1947, which provided for the forfeiting of some deposits and the transformation of others into claims on the Federal Treasury. An exchange campaign helped drastically reduce the amount of cash in circulation: The banknotes printed in 1945 were withdrawn from circulation and exchanged for new schilling banknotes at a ratio of 3 to 1. Only ATS 150 per person were exchanged at a ratio of 1 to 1.

The influence of the social partners made an important contribution to controlling inflation. The employers’ and employees’ organizations agreed in the summer of 1947 to administer prices for key commodities, as well as to raise wages to the extent needed to compensate for inflation. The result was the first of a total of five price and wage agreements between the social partners. Nonetheless, prices continued to rise sharply until 1952, when the central bank threw its weight behind lowering inflation by implementing a restrictive monetary policy. In addition, the domestic economy benefited from the fact that the end of the Korean War also eased pressures on the world economy.

Independence regained

After several decades marked by numerous political breaks, a more open atmosphere was now regaining the upper hand in Austria’s intellectual, cultural, political and economic life. Increasing material security helped promote the forces that were seeking a new identity for a modern, post-war Austria. Waves of refugees arriving from Hungary in 1956 and from Czechoslovakia in 1968 reminded Austrians how fragile their recent progress was.

On September 8, 1955 – in the same year in which the Austrian State Treaty was signed – parliament (the Nationalrat) passed a new Nationalbank Act (still applicable as amended in 1984). Though the law contains provisions that are to a certain extent restrictive – the central bank is obliged to take into consideration the federal government’s economic policy when exercising monetary and credit policy – it guarantees in particular that the central bank is independent of any obligation to lend to the public sector. Additionally, the operational framework of the central bank was expanded to include open market operations and minimum reserves.

Stability guaranteed

For more than a decade up to the end of the 1960s, the key indicators bore testimony to the high internal and external stability of the Austrian economy, underpinned by a well-balanced fiscal and monetary policy that allowed for high economic growth along with low inflation while avoiding long-term external imbalances. Hence, monetary policymakers were able to focus on refining the institutional framework without being forced to intervene permanently.

Austria contributed to European integration by joining EFTA (the European Free Trading Area) in 1960.

During the second half of the 1960s, it became more and more obvious that the Bretton Woods System (the international currency system based on gold/dollar convertibility) could not be maintained in the long run. The U.S.A. was confronted with continuous balance of payments deficits, and the economically and financially most powerful European countries had to deal with recurring current account imbalances. These circumstances made it indispensable to reform monetary policy radically. For the moment, a more flexible multilateral adjustment of exchange rates seemed to be an attractive option.

Restrictions of capital movements, which were imposed in response to the United States’ balance of payments problems, led to the formation of a Eurodollar market in Europe. The gold convertibility of the U.S. dollar was formally lifted mid-1971, effectively ending the Bretton Woods System.

Coordinated policies

In the 1970s, Austria’s willingness to carry out reforms and its stability consciousness were put to a hard test. A recession abruptly interrupted the periods of rapid economic growth in 1975. Toward the end of the decade, skepticism about the “Austrian model,” previously much admired internationally, was on the rise.

Though Austria took various measures, the inflow of foreign capital had – by the early 1970s – climbed to a level that was incompatible with the domestic stability objective. Following the unpegging of the schilling’s exchange rate from the U.S. dollar, policymakers ultimately adopted the strategy of using a basket of “indicator currencies” as a benchmark for actively determining the schilling’s exchange rate: the European currency “snake” system, so called because the currencies of the participating countries were only allowed to fluctuate against each other by a set margin, like the movements of a snake.

After the first oil price shock and the persistent economic slump, Austrian economic policymakers tried to steer the economy by using a broad and harmonized set of measures including limits on the amount of bank lending, restraint in wage increases, demand-side and supply-side fiscal stimulation as well as a temporary attempt to conduct an independent low interest-rate policy. Toward the end of the 1970s, it became more and more obvious that the system of manifold regulations and interventions hampered necessary structural change, also in the banking sector. In 1979, the authorities finally had to relinquish the effort to conduct an independent policy of low interest rates.

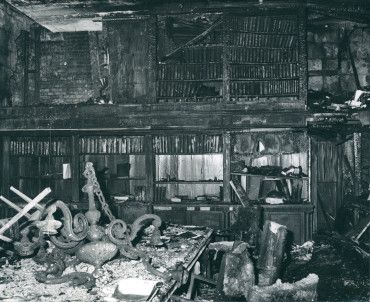

1979 was a tragic year with major consequences for the OeNB’s head office in Vienna. During the night of August 29, a big fire broke out. The fire and the water used to fight the fire destroyed five stories of the building. The entire management floor with the General Council meeting room and the library was completely demolished. The architecture of the building was completely revamped during the restoration work from 1980 to 1985 under the planning of Carl Appel. The most obvious sign of renewal is the mansard roof.

Forward-looking integration

Strengthening economic efficiency by promoting competitive performance became the leitmotiv of the socio-political reform ideas of the 1980s. As Eastern Europe opened up at the end of the decade and the map of Europe was redrawn, Austria found itself in a more central geographical position. In this atmosphere, it finally became possible to openly discuss ways to find a viable solution for a united Europe even if different interests were involved.

The experience of the 1970s prompted policymakers to align the schilling exchange rate with the rate of the Deutsche mark to help ensure internal price stability. Such informal integration into a greater monetary area additionally stimulated structural change in the Austrian economy: Austrian enterprises could survive only by delivering sustained productivity increases. Under such circumstances, the monetary policy of the 1980s was directed toward providing for stability while at the same time forcing economic agents to accept compromises.

Austria’s economy rose to this challenge. However, the path was rocky. At first, unemployment surged and remained at persistently high levels. In the second half of the 1980s, real growth accelerated again. The Austrian economy became more competitive and thus also managed to avoid accumulating large current account imbalances.

The most important economic event of the 1990s was that Austria joined the European Union along with Sweden and Finland (1995). Austria also joined the Exchange Rate Mechanism of the European Monetary System (EMS) in 1995.

For Austria to meet the legal preconditions for participating in Stage Three of Economic and Monetary Union (EMU) as of January 1, 1999, the Nationalbank Act was amended accordingly in April 1998. The amendment expressly states that in fulfilling the tasks and objectives of the European System of Central Banks (ESCB), the Oesterreichische Nationalbank and its decision-making bodies are to act independently of Community institutions or bodies and any governments of the Member States.