Logistics

Cash logistics – the management of the smooth flow of cash, from its production to its use by the public – is in the hands of cash experts.

Production

In April 2001, the Governing Council of the ECB decided that after the changeover to the euro, the production of euro banknotes would be based on a decentralized pooling system. Under this arrangement, since 2002, each Eurosystem national central bank (NCB) has been responsible for procuring an allocated share of the total requirement for certain denominations. Each NCB bears the production cost of its allocated share.

Austria’s share is printed by the Oesterreichische Banknoten- und Sicherheitsdruck GmbH (OeBS). The OeBS’s primary task consists in producing banknotes. The company excels at combining innovative security features with modern designs.

OeBS is a professional in the fields of mechanics, microelectronics, software. It develops and maintains complex analysis centers and control systems and applies a coherent quality management system – thus providing security, building trust and maintaining high quality.

Information about the annual production volumes and denominations allocated to the NCBs is published on the website of the ECB.

In September 2002, the Governing Council of the ECB decided to build up a strategic reserve for the Eurosystem, the Eurosystem Strategic Stock (ESS). This reserve is to be tapped if an exceptional need arises, i.e. if the Eurosystem’s logistical stocks are insufficient to cover an unexpected increase in demand for banknotes or if supply is interrupted suddenly.

The logistical and strategic stocks ensure that the NCBs can handle any change in demand for banknotes at any time, irrespective of whether the demand comes from inside or outside the euro area.

Under normal circumstance, the logistical reserves are high enough to supply the banknotes needed. Logistical reserves are used to

- replace banknotes that are no longer fit for circulation (i.e. low-quality banknotes),

- cover an expected rise in banknote demand,

- meet seasonal fluctuations in demand, and to

- ensure optimum banknote transport logistics between central bank branches.

Distribution

In legal terms, the ECB as well as the euro area NCBs are entitled to issue euro banknotes. In practice, the NCBs issue and withdraw euro banknotes and coins. The ECB does not have a cash office and is not involved in any cash operations. The euro area countries are entitled to issue euro coins. At the euro area level, the European Commission coordinates all euro coin-related issues.

The ECB’s task consists in supervising the NCBs’ activities and in promoting the ongoing harmonization of cash services in the euro area.

The NCBs are responsible for the functioning of their national cash distribution systems. They put into circulation banknotes and coins through the banking system and to a lesser degree through retailers.

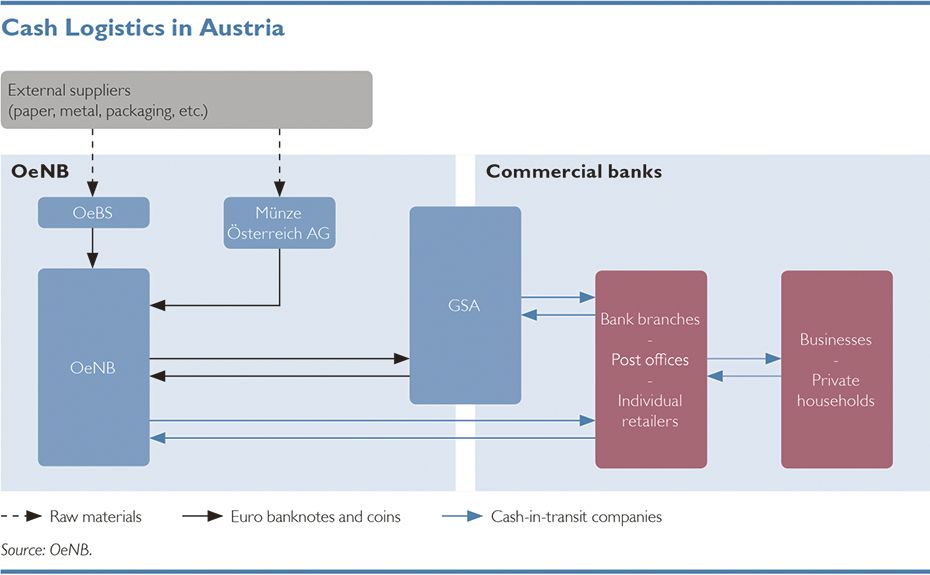

Cash logistics are traditionally based on a cyclical system. Once the process of printing banknotes at the printing works or striking coins at the mint has been completed, the central bank takes charge of the notes and coins and distributes them to commercial banks, which then supply the economy – businesses and households – with cash. The cash returns to the central bank by way of the commercial banks. The central bank processes the cash, examining whether it is fit to be put into circulation again, and sorts out unfit banknotes and coins. Banknotes fresh from the printing press or fit for circulation banknotes and newly minted coins are supplied to the commercial banks.

However, this traditional approach has frequently been called into question. The need to cut costs and increase efficiency has led to the development of new models. In many countries, the central bank has retired from this model and left processing and withdrawal of unfit cash to commercial banks. The NCBs only remain in charge of issuing new banknotes and coins.

In Austria, the establishment of Geldservice Austria (GSA), which today is the OeNB’s wholly owned subsidiary, has ensured the Austrian central bank’s active involvement in the cash cycle.

The GSA’s main task is to handle banknotes and coins. Specialization and cooperation have made it possible to achieve economies of scale in cash handling, thus enabling both commercial banks and the OeNB to reduce costs. Moreover, the OeNB’s control function ensures that banknotes in circulation fulfill the strict quality criteria agreed in the Eurosystem to maintain the public’s trust in the currency.