How monetary policy works

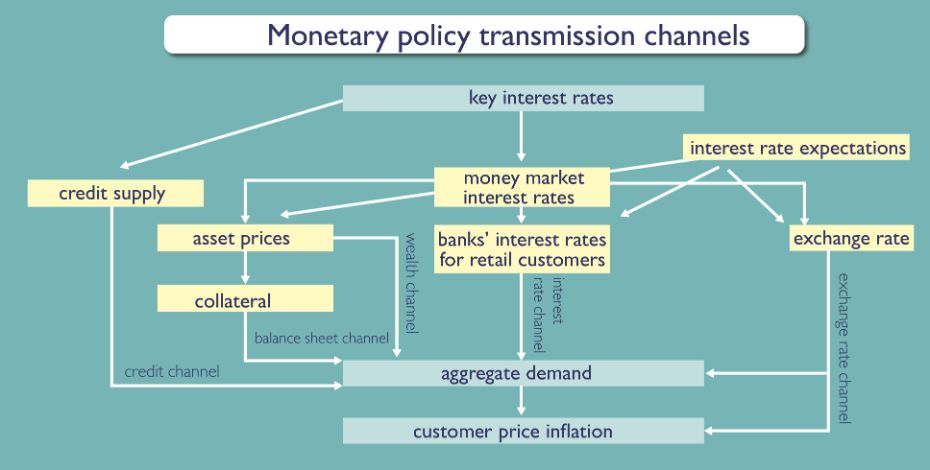

Monetary policy impacts the economy and the price level through various channels. The process by which monetary policy decisions are transmitted to the real economy is called the monetary policy transmission mechanism.

The (long) chain of cause and effect linking monetary policy decisions with the price level starts with a change in the official interest rates set by a central bank on its own monetary policy operations. By changing its key interest rates, a central bank exercises major influence on the money market and may steer the prevailing money market rates. Changes in these rates, in turn, impact on other (longer-term) interest rates.

The monetary policy transmission mechanism

The process through which a central bank’s interest rate policy decisions affect the economy in general, and the price level in particular, is known as the monetary policy transmission mechanism. The transmission of monetary policy impulses to the real economy takes place through various channels and measures taken by economic agents. Monetary policy measures usually take a considerable time to have an effect on price developments.

Interest rate channel

Through the interest rate channel, a raise in key interest rates triggers an increase in short-term market rates. Given stable inflation expectations, as a result, both the real interest rate and the real cost of capital rise, putting a brake on investment. Additionally, household saving goes up and consumption goes down as interest rates rise. This, in turn, causes demand to weaken.

When demand sinks below supply, the result is downward pressure on prices. Moreover, reduced domestic demand may translate into tighter conditions in labor and intermediate goods markets, which in turn dampens price and wage setting in the respective markets.

This means that a key interest rate hike slows down the overall rise in prices.

Conversely, an easing of interest rate policy has the opposite effect. A cut in key interest rates boosts both demand and GDP growth, and inflation goes up.

Exchange rate channel

What happens to exchange rates when key interest rates are raised? Rising domestic interest rates provide an incentive to invest in the domestic currency rather than in foreign currencies. The inflow of funds into the domestic currency area causes the domestic currency to appreciate.

As a result, domestic goods become more expensive than imported goods. As demand for domestically produced goods drops, aggregate domestic output contracts as well. The impact of monetary policy transmission through the exchange rate channel increases with the openness of an economy.

In addition, the transmission via the exchange rate channel directly affects inflation. If the domestic currency appreciates, imported goods and services become more affordable, which keeps a lid on inflation.

Wealth channel

Monetary policy decisions are also transmitted through the price of assets such as stocks and real estate. On the one hand, monetary tightening (i.e. key interest rate hikes) makes bonds look more attractive for investors than stocks, as bonds promise higher returns after a rise in interest rates. As a consequence, demand for stocks contracts, which – in turn – dampens stock prices. Moreover, interest rate hikes make it more expensive to finance housing, thus dampening demand for housing. This, in turn, causes real estate prices to go down.

- Lower stock and real estate prices make a dint into the wealth of households, whose resources shrink accordingly. Lower consumption growth ensues, which goes hand in hand with dampened aggregate demand.

- Reduced stock prices moreover drive up the cost of raising capital for companies, as they receive less per share. As a consequence, companies’ investment spending declines, which results in subdued demand.

- Last but not least, lower demand puts downward pressure on prices, as pointed out above (see “Interest rate channel”).

Balance sheet channel

Changes in the prices of real estate, stocks and other assets do not only impact the resources that households and businesses have at their disposal but also their ability to take out loans. Once asset prices are on the decline, net assets in the balance sheet fall, too. If the value of net assets goes down, their value as collateral for loans to households and businesses naturally declines as well. This, in turn, curbs lending, reduces investment spending as well as consumption and hence dampens aggregate demand, which, in turn, puts a brake on inflation.

Credit channel

Key interest rate changes have an effect on the supply of credit. Following a key interest rate hike, the refinancing conditions for banks deteriorate because

- money market rates increase,

- banks have to pay higher interest on household deposits,

- and banks’ balance sheets deteriorate as well.

Once refinancing becomes more difficult (i.e. expensive) for banks, they tend to keep new lending fairly tight. The supply of credit thus contracts. In response to key interest rate hikes, the risk that some loans cannot be repaid as agreed (i.e. default risk) rises as well. The default risk may become so high that banks stop granting new loans, and the supply of credit goes down. In both cases, households and businesses inevitably have to postpone plans for consumption and investment.