The Eurosystem’s monetary policy strategy

A central bank’s strategy provides the framework for its monetary policy decisions. The strategy specifies monetary policy objectives, the instruments available for the implementation of these objectives as well as the indicators which form the basis for monetary policy decisions.

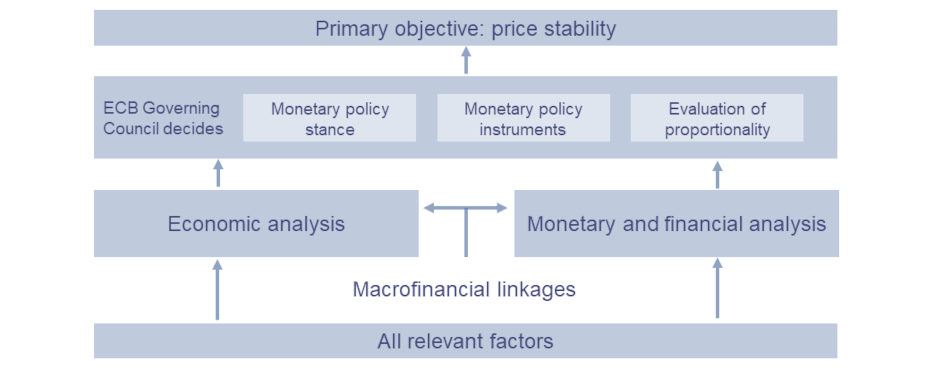

The Eurosystem’s monetary policy decisions, as well as the evaluation of the proportionality of such decisions and of their potential side effects, are based on an integrated assessment of all relevant factors. This assessment builds on two interdependent analyses: economic analysis and monetary and financial analysis. Economic analysis focuses on real and nominal economic developments (e.g. in GDP and inflation forecasts), whereas monetary and financial analysis examines monetary and financial indicators (e.g. financial market developments, monetary and credit growth or bank resilience) as well as financial stability aspects that are relevant for monetary policy. It focuses on the operation of the monetary transmission mechanism and the possible risks to medium-term price stability from financial imbalances and monetary factors. Since macrofinancial linkages play a key role in economic, monetary and financial developments, monetary policymaking must take the mutual dependencies of the two analyses fully into account.

The current framework reflects changes in the ECB’s economic as well as monetary and financial analyses since 2003, the importance of monitoring the transmission mechanism in calibrating monetary policy instruments and the recognition that financial stability is a precondition for price stability.