The OeNB in the Eurosystem

In its role as the central bank of the Republic of Austria, the Oesterreichische Nationalbank (OeNB) has been part of the Eurosystem since the completion of Economic and Monetary Union (EMU) and the introduction of the euro in 1999.

The Eurosystem is responsible for the single monetary policy in the euro area, the world's second-largest economic area after the U.S.A. It consists of the European Central Bank (ECB) and the national central banks of the EU Member States that have introduced the euro.

History of the Eurosystem

The creation of the euro area and the establishment of a new supranational institution – the European Central Bank (ECB) – were milestones in the long and complex process of European integration.

Three stages to EMU

The euro area was created on January 1, 1999, when the national central banks of eleven EU Member States handed over their responsibility for monetary policy to the Eurosystem. Meanwhile, eight other EU countries have introduced the euro.

Euro area countries by year of joining

2023: Croatia

2015: Lithuania

2014: Latvia

2011: Estonia

2009: Slovakia

2008: Malta, Cyprus

2007: Slovenia

2001: Greece

1999: Austria, Belgium, Finland, France, Germany, Ireland, Italy,

Luxembourg, the Netherlands, Portugal, Spain

Tasks of the Eurosystem

The basic tasks of the Eurosystem are set out in Article 127(2) of the Treaty on the Functioning of the European Union (TFEU). They are

- to define and implement the monetary policy of the euro area;

- to conduct foreign exchange operations consistent with the provisions of Article 219 (TFEU);

- to hold and manage the official foreign reserves of the Member States; and

- to promote the smooth operation of payment systems.

The central banks of the Eurosystem have a range of additional tasks.

- The ECB has the exclusive right to authorize the issue of banknotes within the euro area.

- In cooperation with the national central banks, the ECB produces the statistical data necessary for carrying out the Eurosystem's tasks.

- Furthermore, the Eurosystem contributes to the policies pursued by the authorities related to the prudential supervision of credit institutions and the maintenance of financial stability.

Institutional framework of the Eurosystem

European Central Bank (ECB)

The ECB is at the heart of the Eurosystem and the ESCB.

The ECB and the national central banks jointly perform the tasks that have been assigned to them. The ECB has legal personality under public international law.

The legal basis for the single monetary policy are the Treaty establishing the European Community and the Statute of the European System of Central Banks and of the European Central Bank. Both the ECB and the ESCB were established on June 1, 1998 (as laid down in the ESCB/ECB Statute).

European System of Central Banks (ESCB)

27 central banks of 27 EU countries + ECB

The ESCB comprises the ECB and the national central banks of both euro area and non-euro area EU Member States.

Eurosystem

20 central banks of 20 euro area countries + ECB

The Eurosystem is composed of the ECB and the national central banks of the EU Member States that have introduced the euro. As long as there are EU countries that are not part of the euro area, the Eurosystem and the ESCB will continue to exist side by side.

ESCB and Eurosystem key for subscription

Pursuant to Article 28 of the ESCB Statute, the ESCB national central banks are the sole subscribers to the capital of the ECB. Subscriptions depend on shares which are fixed in accordance with Article 29.3 of the ESCB Statute and which must be adjusted every five years (1.1.2004, 1.1.2009, 1.1.2014, 1.1.2019 and 1.1.2024) or with the accession/withdrawal of Member States (accessions: 1.5.2004, 1.1.2007 and 1.7.2013; withdrawal: 1.2.2020). The capital shares of NCBs were adjusted by means of transfers among the national central banks. Adjustments to the key for subscription of the capital of the ECB are based on statistical data in accordance with Council Decision of 15 July 2003. The enlargement of the Eurosystem resulted in adjustments of the Eurosystem key for subcription (1.1.2007, 1.1.2008, 1.1.2009, 1.1.2011, 1.1.2014, 1.1.2015 and 1.1.2023).

Voting rights in the ECB Governing Council

On July 23, 2014, the EU Council approved the accession of Lithuania to the euro area on January 1, 2015. Lithuania is the 19th country to join the single currency area. This euro area enlargement entails a number of changes in the allocation of voting rights in the ECB Governing Council.

Prior to Lithuania's accession, the "one country, one vote" principle applied, with the six members of the ECB Executive Board also having one vote each. To ensure that the Governing Council is able to take decisions in a timely and efficient manner even in an enlarged euro area, the Council of the European Union adopted a decision in 2003 which introduced a rotation system that would apply to the voting rights of NCB governors in the Governing Council as its membership expanded. This new system was first intended to apply as soon as the euro area had 16 members, but this number was later raised to 19. The voting modalities in the ECB Governing Council must therefore change upon Lithuania's accession to the euro area.

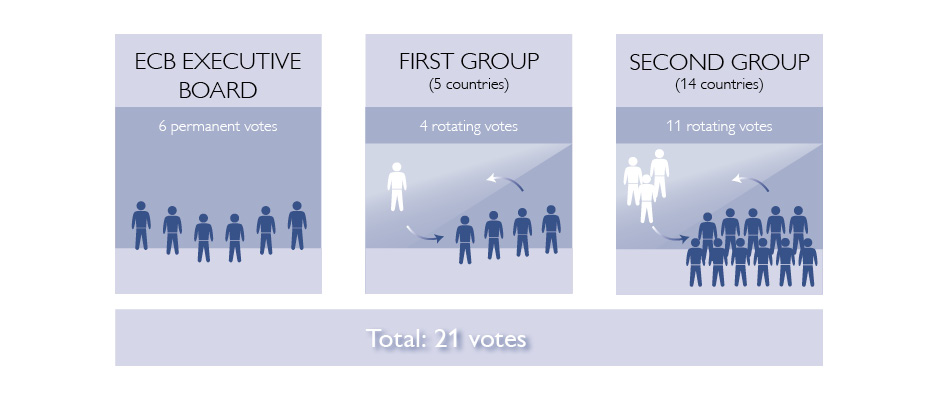

The rotating principle

For 19 to 21 member states

As long as the euro area has 19 to 21 member states, these are divided into two groups. One group comprises the five largest economies in the euro area: Germany, France, Italy, Spain and the Netherlands. These five countries share four rotating votes.

The remaining euro area countries make up the second group, sharing 11 votes. For the current situation with 20 member states, the second group comprises 15 countries sharing 11 votes. This means that four governors of these countries’ NCBS will thus have no vote in the Governing Council for four months each.

Whether currently eligible to vote or not, the representatives of both groups will still be entitled to attend Governing Council meetings and participate in the discussions under the new rotating scheme. They may continue to present their arguments – e.g. on interest rate decisions or other measures – at every Governing Council meeting and thus influence the decisions of the Governing Council.

The rotating principle does not apply to the members of the Executive Board of the ECB, who have a permanent seat and vote in the Governing Council.

| Number of euro area members | First group | Second group | ||

|---|---|---|---|---|

| NCB representatives | Voting rights | NCB representatives | Voting rights | |

| 19 | 5 | 4 | 14 | 11 |

| 20 | 5 | 4 | 15 | 11 |

| 21 | 5 | 4 | 16 | 11 |

For 22 and more member states

Once the number of euro area member states reaches 22, three groups with rotating voting rights will be formed. The five largest economies in Group 1 will continue to share four votes. Group 2 will be comprised of "medium-sized" economies, which will share eight votes. The smallest euro area economies in Group 3 will share three votes. Including the six votes of the Executive Board members, overall Governing Council votes will again total 21.