Single Supervisory Mechanism

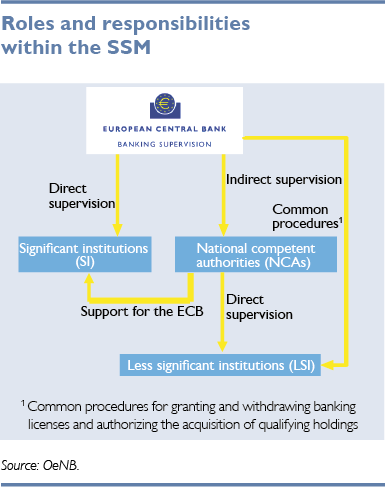

The legal basis for the Single Supervisory Mechanism (SSM) is the SSM Regulation, complemented by the ECB’s SSM Framework Regulation. The SSM, the system of banking supervision in the euro area, became fully operational on November 4, 2014. Under the SSM, the ECB is the supervisor of all banks in the euro area. It shares responsibility for supervision in Austria with Austria’s Financial Market Authority (FMA) – the national competent authority (NCA) – and the OeNB, with each of these institutions having a clearly defined role (see below for more details). Non-euro area EU member states may participate in the SSM on a voluntary basis through close cooperation agreements between the competent supervisory authorities. Reflecting the decentralized nature of supervision under the SSM, the ECB and the national supervisory authorities have different tasks and responsibilities.

The responsibility for supervisory tasks varies depending on whether a supervised bank is deemed a significant institution (SI) or a less significant institution (LSI). The ECB reviews the significance of every bank (i.e. whether it is significant or less significant) at least once a year, assessing the size of a bank, its economic importance and the significance of its cross-border activities. SIs are supervised directly by the ECB via Joint Supervisory Teams (JSTs), consisting of staff of the ECB and representatives of institutions responsible for banking supervision on a national level – in Austria, these are the FMA and the OeNB. Draft supervisory decisions for SIs are prepared by the SSM Supervisory Board, a body including representatives from the OeNB, the FMA and the national supervisors of the other SSM countries. The ECB’s Governing Council adopts the draft decisions proposed by the Supervisory Board under a non-objection procedure.

LSIs are supervised by national authorities in accordance with the principle of proportionality. The intensity and scope of supervision are determined by the systemic importance and risk profile of a bank. The FMA has sovereign powers for the supervision of LSIs in Austria, while the ECB – which is responsible for the effective and consistent functioning of the SSM – has the oversight over the NCAs’ supervision of LSIs. The OeNB is responsible for all tasks related to financial analysis and on-site inspections (fact-finding).

The ultimate decision-making body on SSM planning and action is the Governing Council of the ECB in its SSM composition, which acts on the basis of draft decisions prepared by the SSM Supervisory Board. The decision-making process is based on a non-objection procedure: If the Governing Council does not object to a draft decision proposed by the Supervisory Board within a defined period of time that may not exceed ten working days, the decision is deemed adopted.

The Supervisory Board is composed of the Chair and Vice-Chair, four ECB representatives and one representative of the NCAs in each participating EU country. Austria is represented by a member of the FMA’s Executive Board (voting member) and a member of the OeNB’s Governing Board (non-voting member). The Austrian representative in the Governing Council of the ECB is the Governor of the OeNB.