1818–1878

1816 – 1818 | 1818 – 1878 | 1878 – 1922 | 1922 – 1938 | 1938 – 1945 | 1945 – 1998 | from 1999 |

The Privilegirte Oesterreichische National-Bank

“Erstes Privilegium”

The imperial patent of July 15, 1817, gave the privilegirte oesterreichische National-Bank the exclusive right to issue an unlimited amount of banknotes and to determine the rate for discount transactions.

On January 19, 1818, the permanent bank management was set up.

In the next few years, the central bank systematically established a network of branches to guarantee a smooth money and credit supply. With the head office in Vienna serving as the hub, this network spread to the early industrial regions and trading centers in Central and Eastern Europe as well as the northern Mediterranean region.

Difficulties during establishment

As a matter of principle, the bank was intent on keeping the share of government securities on the asset side of its balance sheet as low as possible. The assets of choice were trade bills and coins. The bills of exchange discounted by the central bank fueled the economic upturn of the monarchy. The banknotes issued were backed by the central bank’s silver reserves, meaning that they were exchangeable for silver coins on demand. In 1818, the bank had assets of 11.5 million florins, whereas the direct (or indirect) government debt with the bank came to 2.2 million florins. Despite the bank’s management long and valiant effort, it eventually failed to prevent its stock of public securities from rising.

The head of the government used to remind the central bank management of its “patriotic responsibilities” in more or less polite words, so the bank was ultimately compelled to buy public securities in times of crisis.

In effect, these “patriotic responsibilities” amounted to advances to the treasury on several occasions: 20 million florins in 1820, 30 million florins in 1821, and 12 million florins in 1831. The circulating banknotes were backed by silver and coin reserves of the bank, with the cover ratio thinning out from 74.6% (1818) to 10.3% (1831).

The rise in the number of banknotes in circulation contrasted with the bank management’s responsibility to the public: Inflation of the money in circulation was bound to affect cash transactions.

The second era from 1841

The clauses of the founding statutes of the privilegirte oesterreichische National-Bank had not been able to guarantee continued autonomy from the government. Central bank independence was a moving target, and maintaining it was a daily challenge for the governors and bank directors. They were forever forced to strike a balance between the amount of banknotes the bank could issue and the amount of public debt it held. The government finally succeeded in reducing the central bank’s independence by shifting the influence on management away from shareholders to the government when it renewed the bank’s monopoly rights in 1841.

During the revolution of 1848, the old order was confronted by a coalition of bourgeois liberals and socialists. Leading bank officials supported the constitutional aims of the 1848 revolutionaries.

Maintaining price stability

The policymakers at the central bank actively monitored the premium to be paid when exchanging banknotes for silver money. Any increase in the premium was equivalent to a depreciation of the notes issued by the privilegirte oesterreichische National-Bank. Such a rise had to be prevented, since an increase in the premium was seen as a harbinger of growing inflationary pressure.

When it tried to stabilize the silver premium, the central bank rapidly reached a limit, as the premium was dependent not only on the central bank’s issuing activity but also reflected the silver price (expressed in terms of gold) and the expected consequences of increased fiscal deficits on money markets. Especially the crises in the years 1848 and 1849 (revolution), 1850 (Prussian-Austrian conflict) and 1853 to 1856 (general mobilization on the occasion of Crimean War) caused the silver premium to rise.

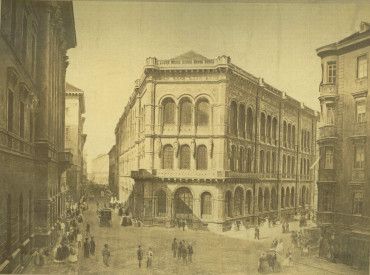

Together with Wiener Börse (the stock market), the central bank moved into a building designed by architect Heinrich Ferstel in 1860. Café Central – the epitome of the Viennese café for decades – was established on the ground floor of this building.

The “Bank Act” of 1862 and the “Big Crash” of 1873

The central bank’s monopoly rights were renewed again (“drittes Privilegium”) on the basis of the law of December 27, 1862 (Imperial Law Gazette No. 2 ex 1863). The most significant change embodied in this law was the reestablishment of central bank independence and its anchoring in law. Furthermore, the volume of banknotes in circulation was limited, mirroring the framework that the Bank of England had introduced under Peel’s Act. Henceforth, issues of banknotes beyond the fixed amount of 200 million florins would have to be backed with precious metal. The law of 1862 was referred to as the “Bank Act,” by analogy to Peel’s Act of 1844.

To fund the war in 1866, the government seriously violated the tenet of central bank independence as established by the Bank Act and the prohibition of issuing banknotes to fund the state. This breach of the central bank’s monopoly rights obliged the public administration to pay compensation. In addition, the central bank’s position was strengthened with the law of March 18, 1872, which authorized the issuance of banknotes up to a maximum of 200 million florins but required any further issues in excess of this amount to be fully backed with silver or gold reserves.

The economic self-confidence of the Hapsburg monarchy was epitomized in the project of a world fair hosted in 1873. However, the management of the central bank was very concerned about the price rally on the Viennese stock market during the run-up to the world fair. Trading practices on the Viennese stock market were ill-suited for warding off sudden setbacks in prices that were threatening to occur. The deals in the forward market hinged on price advances and were hedged by very little collateral. Furthermore, the bull market sharply drove up the prices of the underlying securities, steadily enlarging the room for maneuver to make stock transactions.

Under such conditions, a price slump would invariably cause liquidity to dry up, and that would make prices fall further as a result of distress sales. Prices started to tumble when the world fair did not live up to the expectations it had aroused with its glittering opening. Eventually, the whole stock market was seized by a decline: the Big Crash of 1873.

On May 9, the bankruptcy of Petschek company forced a temporary interruption of trading. Contemporary estimates put the financial loss in 1873 caused by the meltdown in prices at around 1.5 billion florins.

The central bank reacted very prudently. It is true that the temporary suspension of the restrictions on the amount of banknotes in circulation contained in the law of 1872 suited the issuing bank. But even at the climax of the crisis, the money supply exceeded the limit provided for in the Bank Act by only 1%. The leading banks, trades and industries survived the crash without substantial losses, even though the prices of their shares sank to well below the level of 1872.

What had been planned as the apex of the industrial expansion proved to be its end. The anticipated success had failed to materialize, and a period of stagnation followed years of strong growth.