Austrian Economy Emerges from Two-Year Slowdown

The OeNB’s Economic Outlook for Austria for the Period from 2013 to 2015 – December 2013(, Vienna)

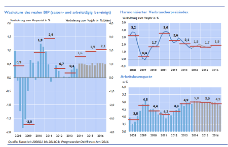

In its December 2013 economic outlook, the Oesterreichische Nationalbank (OeNB) expects the Austrian economy to grow by a moderate 0.4% in 2013. After having stagnated in the first half of 2013, the economy has seen gradual signs of recovery in the second half. Output growth is projected to accelerate to 1.6% in 2014 and 1.9% in 2015, as the global economy will recover and domestic demand components will increasingly expand. Inflation will fall below the price stability objective of 2%. With the euro area clearly experiencing a nascent economic upswing, the Austrian economy has done well to date, as OeNB Governor Ewald Nowotny pointed out, and Austria will continue to record the lowest unemployment in the monetary union.

Moderate Recovery of Global Economic Activity

After having slowed down in the past two years, global economic activity has started to recover and is currently expanding at a moderate pace. While the growth momentum in the emerging markets has been weakening somewhat, economic activity in the industrialized nations – especially in the U.S.A. – is increasingly picking up speed. In the second quarter of 2013, the euro area emerged from recession. The macroeconomic imbalances that built up among euro area countries during the European debt crisis are now decreasing slowly.

The worldwide revival in economic activity will be a major driving force behind the projected upswing in Austria. Following this year’s very modest developments, export growth will advance significantly in the coming two years, and while falling short of precrisis growth rates, it will still provide important support to economy activity. In addition, Austrian exporters are faced with the challenge of price competitiveness. Given decreasing imports, the Austrian current account surplus is set to rise to 3% in 2013 and will improve further in 2014 and 2015.

Domestic Demand Increasingly Fuels Upswing in Austria

Amid persistent uncertainties, investment activity by Austrian companies has been rather subdued since spring 2012. The marked improvement in sentiment, however, gives rise to hopes that investment activity will soon recover. Exceptionally favorable financing conditions and the need for replacement investment should boost investment in plant and equipment. Furthermore, the pace of residential construction investment will quicken on the back of robust housing demand reflected by the strong rise in real estate prices. Consumption has been very subdued recently, as household incomes were contracting in real terms. Private consumption will have stagnated in the year 2013 as a whole. In the subsequent years, consumption will again turn positive owing to continuing employment growth and increasing real wages.

Unemployment Rate Remains Elevated

The labor market is sending mixed signals: On the one hand, employment is expanding despite subdued economic activity. On the other hand, unemployment is on the rise. Austria’s unemployment rate (Eurostat definition) increased from 4.4% in 2012 to 4.9% in 2013. In 2014 and 2015, unemployment is forecast to remain at the elevated level of 5.0%.

Inflation to Fall below the 2% Objective Again

Over the past 12 months, the inflation rate has dropped by almost half in Austria. Falling energy and food prices will dampen inflationary pressures further. Overall, the HICP inflation rate will decrease from 2.1% in 2013 to 1.7% in 2014 and to 1.6% in 2015.

Need for Fiscal Consolidation

One-time effects very much influence the development of the general government budget balance over the forecasting horizon. In 2013, positive one-time effects, such as revenues generated from the telecommunications multiband auction and the tax agreement with Switzerland, have outweighed the negative effects resulting from government aid to banks. The general government budget balance will improve to –1.6% of GDP in 2013 and it is likely to deteriorate in 2014 and 2015 to –2.2% of GDP, as additional government aid for banks remains a possibility. Without the latter, the general government deficit would remain unchanged at –1.6% of GDP in both years. However, as the structural budget balance projected in the OeNB’s economic outlook (ESCB method) exceeds Austria’s medium-term budgetary objective of a structural deficit-to-GDP ratio of –0.45% for 2015, Austria will have to reduce the deficit by roughly EUR 3 billion in 2014 and 2015 to ensure fiscal sustainability.

| 2012 | 2013 | 2014 | 2015 | |||||

|---|---|---|---|---|---|---|---|---|

| Economic activity | ||||||||

| Annual change in % (real) | ||||||||

| Gross domestic product | +0.7 | +0.4 | +1.6 | +1.9 | ||||

| Private consumption | +0.4 | +0.0 | +0.7 | +1.1 | ||||

| Government consumption | −0.3 | +0.7 | +1.3 | +1.3 | ||||

| Gross fixed capital formation | +1.9 | −0.7 | +2.2 | +2.4 | ||||

| Exports of goods and services | +1.7 | +1.6 | +3.7 | +5.2 | ||||

| Imports of goods and services | +0.0 | +0.1 | +3.7 | +5.2 | ||||

| Annual change in % | ||||||||

| Prices | ||||||||

| Harmonized Index of Consumer Prices (HICP) | +2.6 | +2.1 | +1.7 | +1.6 | ||||

| Income and savings | ||||||||

| Real disposable household income | +1.1 | −1.0 | +0.8 | +1.4 | ||||

| % of nominal disposable household income | ||||||||

| Saving ratio | 7.4 | 6.5 | 6.7 | 7.0 | ||||

| Annual change in % | ||||||||

| Labor market | ||||||||

| Unemployment rate (Eurostat definition) | +1.5 | +0.7 | +0.6 | +0.7 | ||||

| % of labor supply | ||||||||

| Arbeitslosenquote laut Eurostat | 4.4 | 4.9 | 5.0 | 5.0 | ||||

| % of nominal GDP | ||||||||

| Budget balance2 | ||||||||

| Budget balance (Maastricht definition) | −2.5 | −1.6 | −1.6 (−2,2) | −1.6 (−2,2) | ||||

| Government debt | 74.0 | 74.2 | 73.7 (74,3) | 72.8 (74,0) | ||||

| Source: 2012: Eurostat, Statistics Austria; 2013 to 2015: OeNB December 2013 Economic Outlook. | ||||||||

| 1 The outlook was drawn up on the basis of seasonally adjusted and working-day adjusted national accounts data. Therefore, the values for 2012 may deviate from the nonadjusted data released by Statistics Austria. | ||||||||

| 2 Figures in parentheses include possible government aid for banks. | ||||||||