Growth Remains Weak in 2015 – Economic Slack Enters Fourth Year

The OeNB’s Economic Outlook for Austria for the Period from 2014 to 2016 (December 2014)(, Vienna)

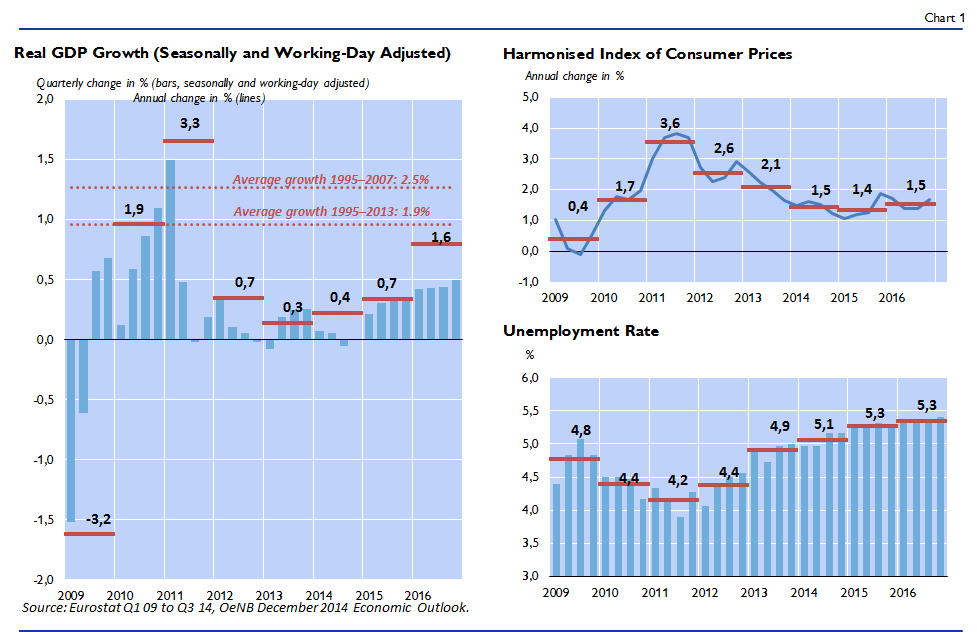

In its economic outlook of December 2014, the Oesterreichische Nationalbank (OeNB) expects the Austrian economy to grow by only 0.4% in 2014. The leading indicators currently available do not provide any clear signs that economic activity will gain substantial momentum in 2015. Growth is expected to accelerate only marginally, to reach 0.7% next year. This implies that the period of sluggish economic activity that started in 2012 is set to enter into its fourth year. The OeNB projects growth to pick up notably – to 1.6% – only in 2016. The OeNB's previous outlook of June had to be revised significantly downward. The growth rates anticipated for 2014 and 2015 are each about 1 percentage point below the previously forecast figures; GDP growth for 2016 was revised downward by half a percentage point. On the back of slow growth, unemployment is set to increase to 5.3% in 2015. Inflation is expected to hover around its current level of about 1.5%. The general government deficit will deteriorate to –2.4% of GDP, but improve significantly in 2015 and 2016 (to –1.8% and –1.4% of GDP, respectively).

Sluggish World Trade Growth Weighs on Exports

Global economic activity in the year to date was more muted than expected as recently as the mid-year. One reason for this is faltering growth in the euro area, which is likely to continue into 2015. The outlook for Germany, Austria's most important trading partner, has also deteriorated since the spring. Austria's exporters have suffered not only from weak global growth, but also from world trade expanding at a rate that is clearly below average. As a result, Austrian export market growth will accelerate only at a moderate pace – from 3.0% in 2014 to 5.0% in 2016 – and thus far more slowly than before the crisis, when growth rates averaged 7.0%. The contribution of net exports to growth will consequently be small over the forecasting horizon.

Companies Remain Hesitant about Investment

Domestic demand will therefore have to play an increasing role as a driver of growth. Still, the contribution of investment will be smaller than in periods of normal economic growth. It is assumed that the high degree of uncertainty regarding sales prospects at home and abroad will recede only slowly, so that investment activity will remain rather muted overall. The comparatively modest growth of investment will result primarily from investment in equipment and investment in residential construction, with the latter benefiting from rising real estate prices, favorable financing conditions and a heightened demand for housing. Civil engineering is set to remain below average on account of low public sector demand.

Low Inflation Supports Private Consumption

Private consumption is forecast to remain subdued in 2014 and 2015. In 2016, a pick-up in real wage growth will provide some impetus to consumption growth. Real wages will rise more strongly on the back of continuously low inflation. The upward movement of prices has decelerated in the course of 2014; HICP inflation stood at 1.4% in October, clearly below the annual rate for 2013 (2.1%). From 2014 to 2016, inflation is expected to fluctuate around 1.5%. The slow increase in prices is attributable to weak economic growth, low world market prices for crude oil, and moderately rising wage costs.

Unemployment Climbs Further to 5.3%

As in previous years, employment is following cyclical developments with a lag. While payroll employment growth was 0.9% in 2014, it is expected to bottom out at 0.4% in 2015, and to accelerate to 0.6 % as the economy picks up steam in 2016. The increase in the number of annual hours worked will continue to be marginal. The unemployment rate will rise gradually over the forecasting horizon, from 4.9 % in 2013 to 5.3 % in 2016. In addition to cyclical effects, the job market also reflects the impact of a growing labor participation rate among older workers and the influx of foreign workers.

Budget Balance at –2.4 % in 2014

The general government budget balance will widen to –2.4% of GDP in 2014. This deterioration in the fiscal balance is due, in particular, to the large increase in capital transfers to banks in the course of the reorganization of Hypo Group Alpe Adria. With these capital transfers decreasing in the years thereafter, the budget balance is set to improve to –1.8% and –1.4% of GDP in 2015 and 2016, respectively. The increase in the public debt ratio to 85.4% of GDP in 2014 was also driven by the reorganization of Hypo Group Alpe Adria. The public debt ratio will see a trend reversal in 2015 and fall to 82.9% of GDP by end-2016.

| 2013 | 2014 | 2015 | 2016 | |

|---|---|---|---|---|

| Annual change in % (real) | ||||

| Economic activity | ||||

| Gross domestic product2 | +0,3 | +0,4 | +0,7 | +1,6 |

| Private consumption | −0,1 | +0,5 | +0,7 | +1,3 |

| Government consumption | +0,4 | +1,0 | +1,4 | +1,3 |

| Gross fixed capital formation | −0,9 | −0,1 | +0,8 | +2,3 |

| Exports of goods and services3 | +0,9 | +0,8 | +2,4 | +4,6 |

| Imports of goods and services3 | −0,2 | +0,5 | +2,5 | +4,7 |

| % of nominal GDP | ||||

| Current account balance | +1,0 | +0,4 | +0,6 | +0,8 |

| Annual change in % | ||||

| Prices | ||||

| Harmonized Index of Consumer Prices (HICP) | +2,1 | +1,5 | +1,4 | +1,5 |

| Income and savings | ||||

| Real disposable household income | −2,0 | +0,1 | +1,1 | +1,4 |

| % of nominal disposable household income | ||||

| Saving ratio | 7,3 | 6,8 | 7,1 | 7,2 |

| Annual change in % | ||||

| Labor market | ||||

| Payroll employment | +0,8 | +0,7 | +0,4 | +0,6 |

| Hours worked (employees) | +0,3 | +0,5 | +0,2 | +0,5 |

| % of labor supply | ||||

| Unemployment rate (Eurostat definition) | 4,9 | 5,1 | 5,3 | 5,3 |

| % of nominal GDP | ||||

| Budget balance | ||||

| Budget balance (Maastricht definition) | −1,5 | −2,4 | −1,8 | −1,4 |

| Government debt | 81,2 | 85,4 | 84,6 | 82,9 |

| Source: 2013: Eurostat, Statistics Austria; 2014 to 2016: OeNB December 2014 Economic Outlook. | ||||

| 1 The outlook was drawn up on the basis of seasonally adjusted and working day−adjusted national accounts data. The values for 2013 therefore deviate from the nonadjusted data released by Statistics Austria. Calculated in line with the ESA 2010. | ||||

| 2 Real GDP figures are based on the first complete publication of the quarterly national accounts for the third quarter of 2014, and the expenditure−side GDP components on the flash estimate of the quarterly national accounts for the third quarter of 2014. | ||||

| 3 When the national accounts were moved to the ESA 2010 framework, external trade data showed discrepancies vis−à−vis the goods trade data released by Statistics Austria and the services trade data compiled by the OeNB. For this reason, exports and imports were calculated based on the latter data sources. | ||||